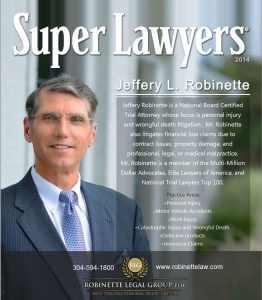

By Jeff Robinette

As a Morgantown car accident lawyer who has spent decades litigating cases, I have seen many tragic situations where those involved were seriously and permanently injured, but their insurance coverage was insufficient to compensate them for the medical bills, pain, suffering, and lost wages that resulted from their car wreck. If only these people had spent a little more on insurance premiums before the collision, they would have had the insurance coverage needed after the accident to meet these unwanted and unexpected sudden needs.

Mandatory Automobile Insurance

You probably are already aware that the purchase of automobile liability insurance coverage is mandatory in West Virginia. When you have your vehicle inspected, the auto shop asks for proof of insurance coverage. State law requires insurance companies to offer automobile insurance coverage at minimum levels to every owner of automobiles so that theoretically every vehicle being operated on state highways has at least a minimum amount of liability coverage protection in the event of a collision. But, as the statistics show, there is a high frequency of vehicles being operated without liability insurance coverage. Every responsible driver should purchase enough uninsured and underinsured motorist coverage to protect themselves from all irresponsible drivers. Even the most experienced Morgantown personal injury lawyer is limited by the amount of insurance available to you.

Minimum Liability Limits: 20/40/10

In West Virginia, the minimum level of liability coverage that can be sold by insurance companies is $20,000 per person $40,000 per accident for personal injuries and $10,000 for property damage coverage. In the insurance industry, this coverage is referred to as “20/40/10” liability coverage. This minimum liability coverage protects the at-fault driver from causing injury to another person from a collision. Of course, the owner may choose greater liability protection by purchasing higher coverages, but at a minimum, the vehicle owner must have this minimum coverage. It is best to have more liability coverage, and I recommend to some of my clients, who have paid for their homes and have other personal assets, to purchase at least $500,000 in liability coverage protection. A good rule of thumb to use when buying liability insurance is for every dollar of assets you own, you should have the same amount of liability protection. Remember, one auto collision caused by you could wipe you out financially.

Minimum UM Limits: 20/40/10

West Virginia law also mandates that insurance companies must sell, at the same time liability coverage is purchased, uninsured motorist coverage in the same minimal amount as liability coverage. In the insurance industry, this coverage is referred to as “UM” coverage. UM coverage protects you when you are injured by an uninsured driver, meaning the driver has no insurance coverage. As with liability coverage, you may purchase higher UM coverage for greater protection, which I advise, since West Virginia has a high occurrence of uninsured drivers who cause collisions. Many uninsured drivers are financially unable to afford liability insurance coverage because of their bad driving record – the “high-risk” premiums typically are triple or quadruple the cost of regular liability premium rates.

Optional UIM Coverage

Many auto collisions that cause serious personal injuries will involve an at-fault driver who has insurance coverage, but not enough to pay for all your damages caused by the collision. Thus, the at-fault driver is considered underinsured. You may have these questions: “What if the at-fault driver doesn’t have enough insurance coverage to even pay my medical bills?” Or, “What if the at-fault driver has no insurance coverage at all, who will pay my medical bills and lost wages?” In such cases, you must file an injury claim against your insurance policy — assuming that you have purchased such coverage — to pay for these damages. You have every reason to be concerned about the financial responsibility of the at-fault driver, even when their vehicle was a newer model than your own. According to statistics, about one out of every six vehicles traveling on West Virginia roads has no insurance coverage. An even greater percentage of drivers have only minimum liability limits, meaning that in many auto collision cases, the injuries will exceed the available insurance coverage of the at-fault driver.

The insurance industry refers to underinsured motorist coverage as “UIM” coverage. UIM coverage provides coverage for you when the at-fault driver doesn’t have enough liability coverage to pay all of your damages. The purchase of UIM coverage is not mandatory, but it must be offered by the insurance company, and you must waive UIM coverage in writing if you don’t want to purchase it. You may purchase underinsured motorist coverage at any amount equal to or above the liability limits you choose. Because few drivers have enough liability coverage, you should purchase your own underinsured motorist coverage. I advise my clients to buy as much as they can afford: the more coverage you purchase, the more you are protected.

Optional Med-Pay Coverage

Most people don’t realize that some of the cheapest insurance coverage available is medical payment coverage, known in the insurance industry as “Med-Pay” coverage. Regardless of who is at fault for the auto collision, this coverage pays for the cost of your necessary medical treatment for the injuries you sustained from the auto collision. Because the cost of medical treatment for a serious injury can be in the hundreds of thousands of dollars, you must purchase the highest Med-Pay coverage offered by your insurance company.

Protect yourself and your family, and don’t be short-sighted. No one expects to be involved in a serious and life-changing auto collision, but by spending a little more now on your insurance, you can gain thousands of dollars more in protection in the event you find you desperately need it.

Jeff Robinette

Jeff Robinette is an award-winning West Virginia Personal Injury and Wrongful Death Attorney with over 30 years of experience handling catastrophic injury cases. Mr. Robinette started his career working for insurance companies, and he now uses that experience to exclusively represent the injured and their families.

Jeff Robinette is an award-winning West Virginia Personal Injury and Wrongful Death Attorney with over 30 years of experience handling catastrophic injury cases. Mr. Robinette started his career working for insurance companies, and he now uses that experience to exclusively represent the injured and their families.

Morgantown, WV is the home base for the Robinette Legal Group, PLLC, but Mr. Robinette and his skilled team represent clients all over West Virginia.

Mr. Robinette is the author of three landmark books, Collision Care: A Guide for West Virginia Car Accidents; Righting the Wrong: A Guide for West Virginia Personal Injury Cases (including workplace injuries), and Beside Still Waters: A Guide for West Virginia Wrongful Death Claims.

Follow Jeff Robinette on Facebook or LinkedIn

Practice Areas

- Personal Injury Overview

- Bicycle Accidents

- Birth Injuries

- Brain Injuries

- Burn Injuries

- Car Accidents

- Cerebral Palsy Birth Injuries

- Commercial Delivery Truck Collisions

- Construction Site Injuries

- Defective Product Injuries

- Dog Bite Injuries

- Drunk Driver (DUI) Accidents

- Gas Explosion Injuries

- Insurance Claim Disputes

- Medical Malpractice

- Mining Accident Injuries

- Motorcycle Accidents

- Pedestrian Accidents

- Rear-End Collisions

- Scaffold & Ladder Fall Injuries

- Shoulder Dystocia Birth Injuries

- Slip And Fall Accidents

- Spinal Cord Injuries

- Truck Accidents

- Uninsured Motorists

- Work Accidents

- Wrongful Death

- Wrongful Diagnosis